Welcome to AftermathCare Services

AftermathCare Services, aim to redefine human resource support to gig workers, particularly in the realm of death claims. Our vision is to create a compassionate environment where employees and their families receive respectful and comprehensive assistance during their time of loss.

We strive to be trusted partner, providing practical support as well as emotional and financial resources for families affected by the death of an employee. By bridging gap in traditional HR framework, we aspire to ensure that employees feels valued and protected, ultimately fostering a cultural care that honors their legacies supports and their loved ones throughout the claim process.

EDLI (Employee Deposit Linked Insurance Scheme)

The Employees Deposit Linked Insurance Scheme (EDLI) is an insurance cover provided by the Employees Provident Fund Organization (EPFO) for private sector salaried employees who are EPFO members. Launched in 1976, the EDLI scheme ensures that the registered nominee receives a lump-sum payment if the insured employee dies during their period of service.

The primary objective of the EDLI scheme is to provide financial assistance to the family of an EPFO member in the event of the member’s death. There are no exclusions under this scheme, and the benefit amount is determined by the employee’s last drawn salary.

Key Features

- Eligibility: Employees with a basic salary up to Rs. 15,000 per month. If the salary exceeds Rs. 15,000, the maximum benefit is Rs. 7 lakhs.

- Benefit Calculation: The claim amount is 35 times the average monthly salary of the past 12 months, up to Rs. 7 lakhs.

- Employee Contribution: Employees do not need to contribute to EDLI; their contributions are only for EPF.

- Bonus: A bonus of Rs. 1.75 lakh is provided.

- Automatic Eligibility: Employees with EPF accounts in organizations with more than 20 employees automatically qualify for EDLI.

- Global Coverage: The insurance coverage is global and round-the-clock, with no exceptions.

- Alternative Insurance: Employers can choose another group insurance plan, but it must offer benefits equal to or greater than those under EDLI.

- Employer Contribution: Employers must contribute 0.5% of the basic salary, up to a maximum of Rs. 75 per employee per month, or up to Rs. 15,000 per month if no other group insurance scheme is available.

- Dearness Allowance: This allowance must be added to the basic salary for all calculations under EDLI.

Documents Required for Claim

To claim the benefit under EDLI, the following documents are needed:

- Completed Form 5 IF

- Death Certificate of the insured person

- Succession Certificate (if the legal heir is claiming)

- Guardianship Certificate (if claimed on behalf of a minor by someone other than the natural guardian)

- Copy of a cancelled cheque for the account where payment is to be received.

About us

In today’s rapidly evolving economy, many gig workers are unprotected and their families unprepared for the unexpected. At AftermathCare Services, we provide specialized support to the families of gig workers, helping them navigate the complex process of settling claims and ensuring they receive the benefits and support they are entitled to after the loss of a loved one.

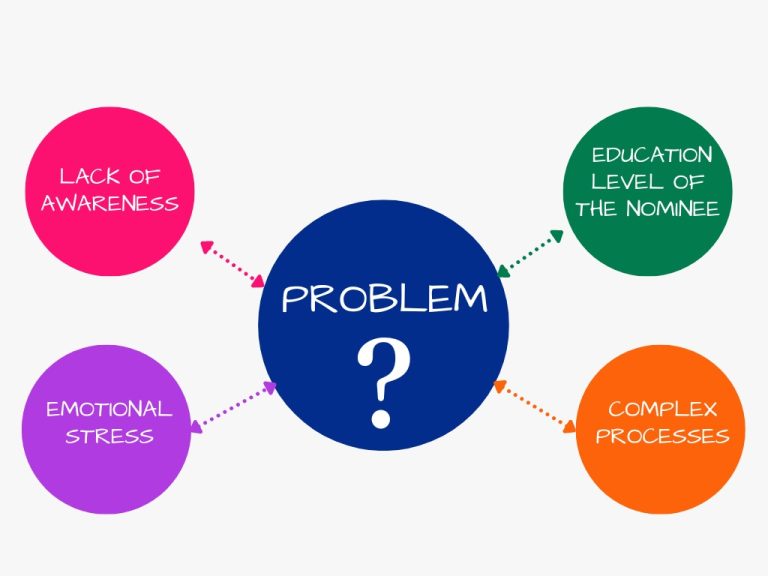

The Problem

Lack of Awareness: Many families are unaware of the benefits and claims available to them when a gig worker passes away.

Complex Processes: The process of filing claims and securing benefits can be daunting and time-consuming, often involving multiple steps and detailed paperwork.

Emotional Stress: Dealing with the loss of a loved one is already overwhelming. Adding financial and administrative burdens can be unbearable

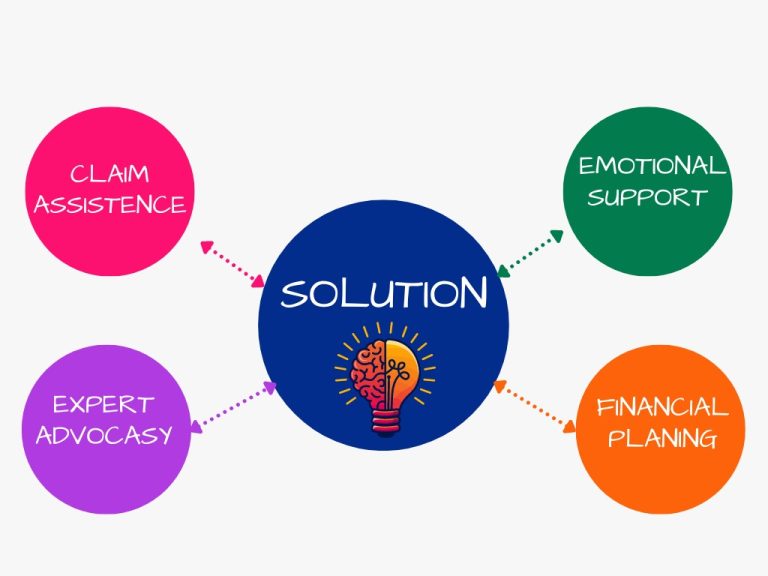

Our Solutions

At AftermathCare Services, we offer a compassionate, comprehensive solution to help families through this difficult time. Our services include:

Claims Assistance: We guide families through the entire claims process, from understanding eligibility to completing and submitting necessary documentation.

Expert Advocacy: Our team of experienced advocates works tirelessly to ensure families receive all entitled benefits, including life insurance, social security, and other relevant claims.

Emotional Support: We provide access to grief counseling and emotional support resources to help families cope with their loss.

Financial Planning: We offer financial planning services to help families manage their finances and make informed decisions about their future.

.

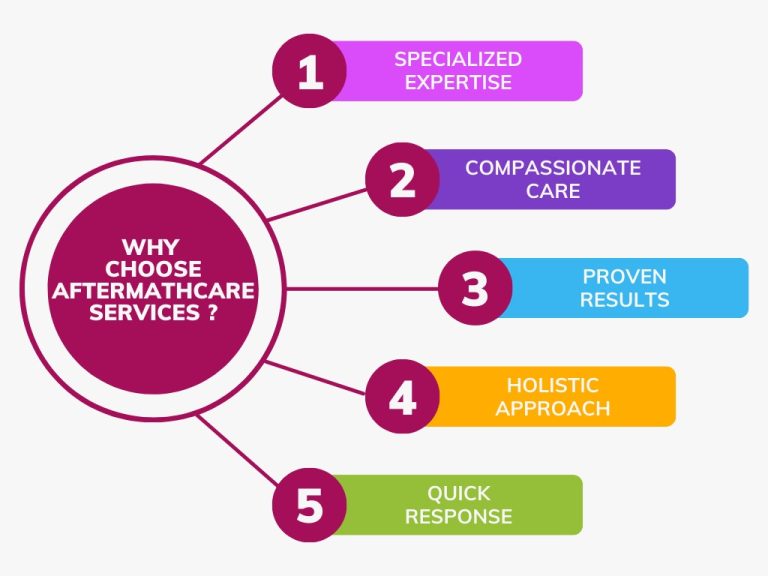

Why Choose AftermathCare Services?

Specialized Expertise: Our team understands the unique challenges faced by gig workers and their families, ensuring tailored support and advice.

Compassionate Care: We approach every case with empathy, understanding the emotional toll that comes with losing a loved one.

Proven Results: We have a track record of successfully helping families secure the benefits they deserve, reducing financial strain during a difficult time.

Holistic Approach: Beyond claims and benefits, we offer comprehensive support to address emotional, financial, and practical need.